Can Lyft Information Be Uploaded Into Quickbooks Self Employed

QuickBooks Self Employed was designed to serve individuals such every bit Freelancers, Uber Drivers, Real Estate Agents, and several independent consultants. Information technology lets you lot track your mileage, income, expenses, etc., and helps automate your accounting procedure.

Having such features, users oft inquire if it'south suitable for them, how much it cost, its advantages and drawbacks, etc. In this regard, we have reviewed QuickBooks Self Employed and explained all the information regarding it. So, let's begin.

Is QuickBooks Self Employed ideal for yous?

While reviewing QuickBooks Self-Employed, we discovered that the benefits and services it offers are suitable according to conditions. Let's find out:

QuickBooks Self Employed is platonic for:

- Freelancers: QuickBooks Self-Employed offers useful features to freelancers similar quarterly tax interpretation, automatic mileage tracking, and mobile invoices. In addition, the dashboard feels easy to navigate.

- Remotely-Working Businesses: Creating invoices, automatically tracking business concern mileage, and tracking the profit and loss anywhere helps remotely-working businesses achieve their goals.

QuickBooks Self-Employed is not platonic for:

- Entrepreneurs with more than one compan y: QuickBooks Self-Employed is not built to serve multiple companies. So, we recommend Turbotax , which we consider ideal for multi-company accounting software.

- Growing businesses : Since the cocky-employed edition of QuickBooks is a single-entry accounting solution, information technology is not platonic for businesses that are growing. For such purposes, nosotros recommend QuickBooks other versions .

- Frequent invoicing : QuickBooks Self-Employed won't save the client, service, or product information, which ways yous must add the details of the buyer and the recipient each fourth dimension yous create an invoice.

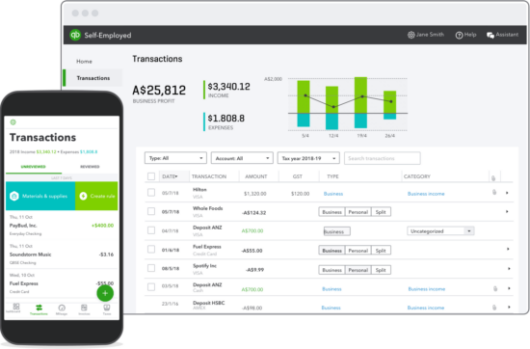

How QuickBooks Self Employed works?

QuickBooks Self-Employed works by connecting all your accounts (checking, PayPal, Credit Cards, etc.) and allows yous to runway your income as well as expenses in one place.

It is necessary to spend some fourth dimension to organize your transactions, however, at a minimum, at the beginning. You can accomplish this by manually classifying the expenses and income as personal or business, or developing rules to automatize the procedure.

In addition to tracking and categorizing boosted expenses, you can also rail the mileage and calculate deductions for it.

Information technology is also possible to create, track and transport invoices, though it only allows a few customizations and doesn't permit estimates, it can produce the following reports for business:

- Mileage Log.

- Receipts.

- Revenue enhancement Details.

- Summary of Tax.

- Profit and Loss.

QuickBooks Self-Employed: Pricing & Features

The pricing of QB Self-Employed comes with iii pricing plans, and they range from $xv to $35 monthly. If y'all want to include revenue enhancement returns and alive assistance from an agent, lawyer, or certified public accountant (CPA), the prices vary.

After reviewing its pricing, we've prepared a table that'll help yous empathise its features equally per the price. See below:

| Pricing & Features | Cocky Employed | Self Employed Revenue enhancement Bundle | Self Employed Alive Tax Bundle |

| Pricing | $fifteen | $25 | $35 |

| Track Mileage | ✔ | ✔ | ✔ |

| Create Customer Invoices | ✔ | ✔ | ✔ |

| Separate Personal & Business organization Expenses | ✔ | ✔ | ✔ |

| Automated Quarterly Taxes Calculation | ✔ | ✔ | ✔ |

| Bank & Credit Bill of fare Connect to Import Transactions | ✔ | ✔ | ✔ |

| Federal & State Tax Render Filing | N/A | ✔ | ✔ |

| Pay Quarterly Estimated Taxes Directly Via QuickBooks | N/A | ✔ | ✔ |

| TurboTax Tax Experts Reviews Your Final Return | N/A | Due north/A | ✔ |

| Unlimited Live Assist Via TurboTax Revenue enhancement Experts | North/A | North/A | ✔ |

The interface of QuickBooks Cocky Employed

QuickBooks Self-Employed comes with a variety of tools to help you keep track of your earnings and expenses. This includes the power to monitor your mileage, link your credit and bank accounts, segregate personal and business organization expenses, download receipts too equally create Profit and Loss (P&Fifty) statements.

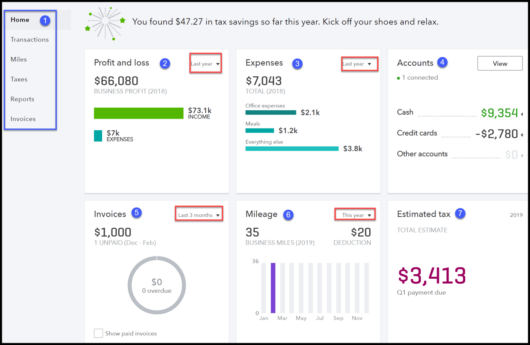

Although QuickBooks Self-Employed does have a P&L account, information technology does not include a balance sheet nor monitors liabilities and avails. Its dashboard provides an insight into profits and losses, invoices, accounts as well equally estimated tax. Let'southward explore its dashboard.

- Left Menu Bar : It allows you to navigate to every role of the plan.

- Profit and loss : Review full income with expenses for whatever flow like last month, this twelvemonth, etc.

- Expenses : Review your total expenses over the specified period of time.

- Accounts : Check the current balance of all credit card and banking accounts.

- Invoices : View invoices that are owed to you by customers.

- Mileage : Keep rails of total mileage using the mileage tracker app by QuickBooks.

- Estimated taxes : Examine the estimated tax you owe by an automatic calculation performed by self-employed QuickBooks.

Beneficial Features of QuickBooks Self-Employed

The QuickBooks Cocky-Employed offers numerous features to its user. While reviewing it, the below-mentioned features attracted us the near.

1: Mileage Tracking

The mileage tracker of QuickBooks Self-Employed can exist downloaded on your iOS and Android. It will automatically monitor all of your auto travel and record your business miles with deductions based on IRS mileage rates.

2: Invoicing

The invoicing section lets you generate and monitor invoices easily. Nonetheless, if you choose to sign upwardly for making an invoice payable online, retrieve that the bank transactions charge aught only the charge per unit for credit carte du jour payments is 2.nine%.

3: Bank Feeds

This characteristic lets you download the credit card and cyberbanking transactions direct into the QuickBooks Self-Employed account. Then, you tin keep the transactions to an appropriate category or as a personal expense.

iv: Receipt Capture

The QB Self-Employed mobile application for Android and iPhone makes receipt capture like shooting fish in a barrel. Just take a snap of any receipt and you tin can attach it directly through your phone.

5: Customer Service and Integration

The all-new design of the QB self-employed dashboard is elementary to utilize and offers a lot of shortcuts. Furthermore, the client service has also improved. You go back up options such equally troubleshooting video tutorials, alive conversation, Learn & Support, QuickBooks blogs, an automated assistant, and an active customs forum.

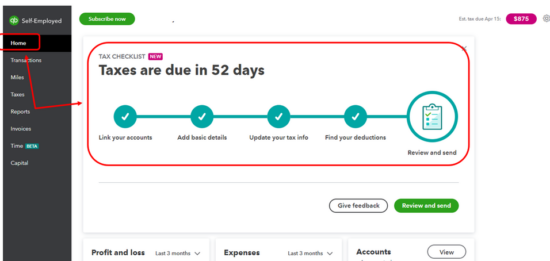

Revenue enhancement-Related Features of QuickBooks Self-Employed

one: Summary printing of Income and Expenses

Now classify your income and expenses with categories to comply with IRS Schedule C, similar legal fees, utilities, and commissions. After you enter this information, print a summary of your income and expenses to ease up your tax filing.

two: Quarterly calculation of Federal Taxation

While setting the revenue enhancement profile, QuickBooks Cocky-Employed volition automatically summate your almanac turn a profit and estimated tax payment for you. Furthermore, you'll get an warning on tax due dates. This protects you from penalties and saves your money.

3: Importing Schedule to TurboTax

If you purchase the tax bundle of QuickBooks Self-Employed, you'll go a subscription for TurboTax. Furthermore, you go to transfer all the Schedule C information to TurboTax with ease. This feature is beneficial to those who do their ain taxes.

iv: State & Federal Revenue enhancement Filing

The Tax Bundle likewise includes land and federal tax returns for only $120 per annum ($10 extra per month). If Purchased separately, the TurboTax Cocky-Employed costs $120 without the state return. If you lot exercise taxes then y'all'll appreciate this.

QuickBooks Self-Employed: Pros & Cons

Every bit we reviewed QuickBooks self-employed, we discovered its advantages as well as some drawbacks. The attached table volition assistance.

| PROS | CONS |

| Rails Personal and Business expenses together. | It's impossible to runway unpaid bills. |

| Calculate estimated taxes for the quarter. | Limited functionality for invoicing |

| Track expenses and mileage from anywhere. | It doesn't have a balance sail |

| Yous can transfer Schedule C to TurboTax. | There is no payroll integration |

If you're self-employed or a freelancer with no contractors or employees, QuickBooks Self-Employed volition be ideal for you. Information technology will help you rails your deductions and employ the data to fill out taxes to get benefits on Tax returns.

In addition, instead of looking for receipts or possibilities for tax deductions, you can use your deduction information and thus eliminate the confusion.

Furthermore, the Tax bundle program lets you file Local likewise as Country tax returns and assist you estimate tax payments for the quarter. With all factors discussed hither, now it's your phone call to apply or non use QuickBooks Self Employed.

Source: https://qberror.com/quickbooks-self-employed/

Posted by: hawkinsantionne.blogspot.com

0 Response to "Can Lyft Information Be Uploaded Into Quickbooks Self Employed"

Post a Comment